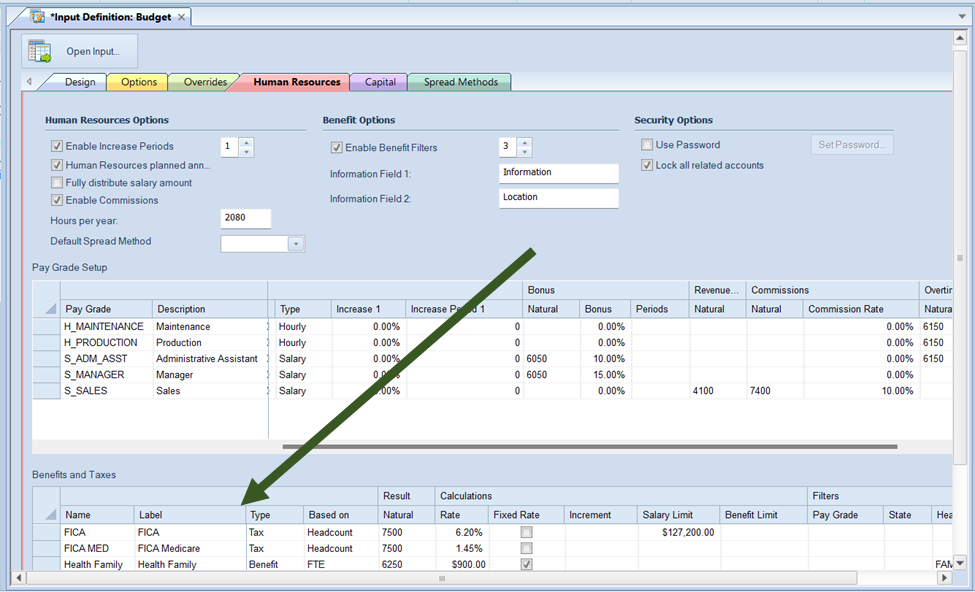

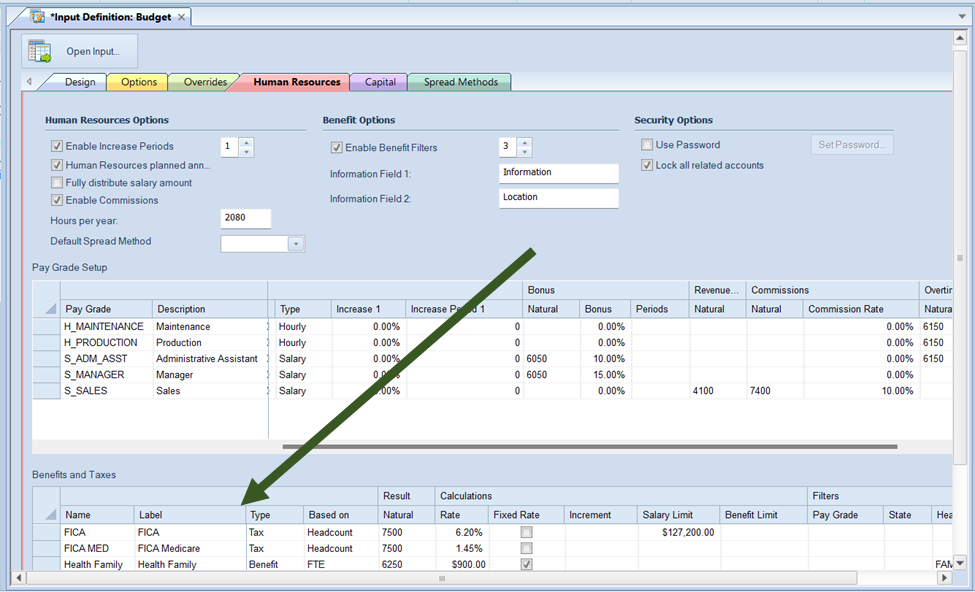

Once a row for a new benefit or tax has been added in the grid, the available action and items on the Human Resources tab include the following options:

•Name – This field is the Name which corresponds benefit or tax name. You may enter an alphanumeric value up to 24 characters.

This option cannot be <BLANK> and must be unique within the list.

•Label – This field is the label which corresponds benefit or tax name. You may enter an alphanumeric value up to 80 characters.

This option cannot be <BLANK>.

•Type – This field indicates if the item is a tax or benefit. You can select either “Benefit” or “Tax” from the dropdown option.

This option cannot be <BLANK>. The default value is “Tax”.

•Result – This field is the result Account associated to the benefit or tax. You can enter a posting-level alphanumeric account value or select an account using the ellipsis button.

This option cannot be <BLANK>.

•Rate – This field is the percentage amount associated to the benefit or tax. You must enter a numeric value.

This option cannot be <BLANK>.

•Fixed Rate – This checkbox field indicates that the item is a fixed rate amount. Fixed rate benefits or taxes will use the employee FTE to calculate the percentage of the rate.

This option is not checked by default.

•Increment – This field is the increment amount in dollars of the benefit or tax.

This option is <BLANK> by default.

•Salary Limit – This field is the salary limit amount in dollars at which the tax is capped.

This option is <BLANK> by default.

•Benefit Limit – This field is the amount in dollars at which the benefit is capped.

This option is <BLANK> by default.

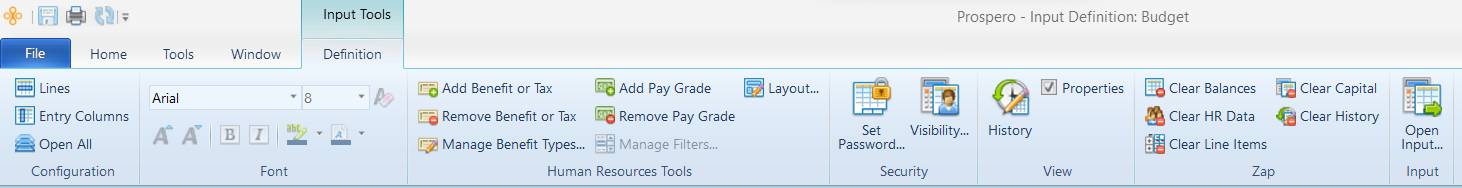

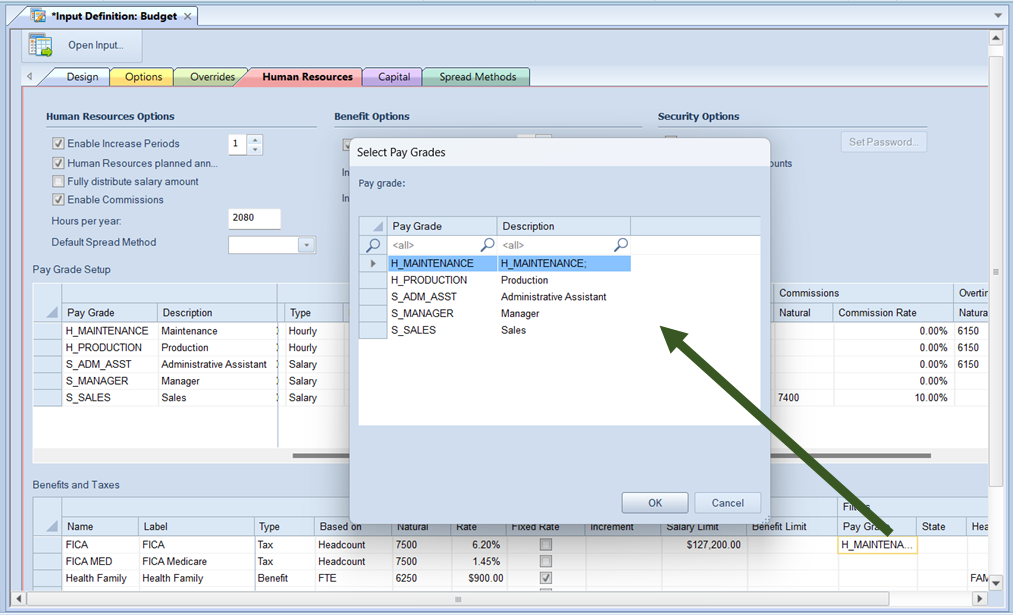

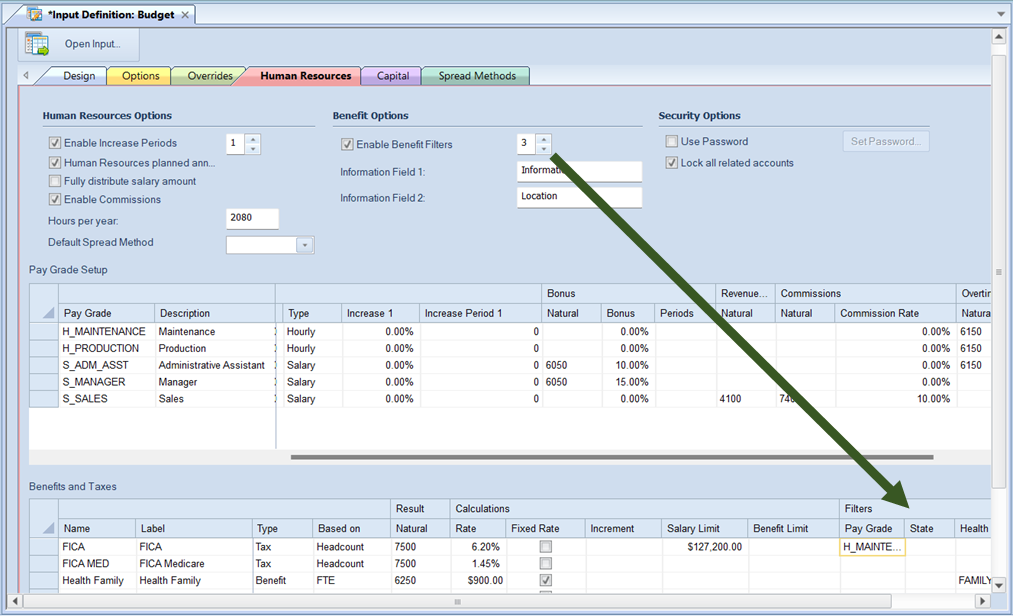

•Pay Grade – This field allows you to specify the Pay Grades to which the benefit or tax is applicable. You must have created Pay Grade(s) in the prior grid.

Select the ellipsis button to select the pay grade which applies to the benefit or tax. You can select multiple pay grades using the Shift + mouse click. When you have made your selection(s), select the Ok button.

This option can be <BLANK> which indicates that the benefit or tax will apply to all pay grades.

This option is <BLANK> by default.

•User Fields – If the Enable Benefit Filters field checkbox is checked on the Input Definition Human Resources tab, based on the number specified, you will have x- number of user-defined fields added.

These User Fields can be used to define the filters for which you wish to apply a tax or benefit (i.e. such as “State”, “Location”, “Department”, etc.) Once the number of User Defined fields are specified, you can customize the field and its value(s). These field(s) are optional.

For more information see Adding Benefit or Tax Field Values.

Once you have defined and saved your Benefits and Taxes, the entries will be listed in alphabetical order in the grid.